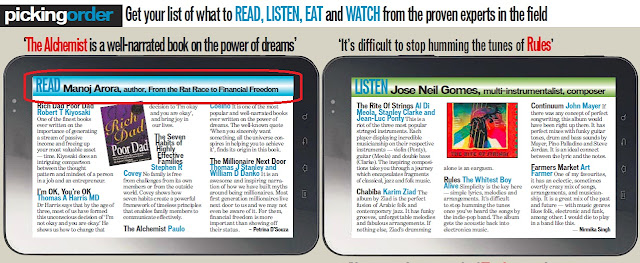

Now, "The Free Press Journal" acknowledges the book - "From the Rat Race to Financial Freedom"

"The Free Press Journal" - one of the renowned daily publication in Mumbai and 4 other Indian cities, acknowledges the attempt made by the book "From the Rat Race to Financial Freedom" as it showcases this book among some other great books and work being done in the field of art and literature.

On Sunday, 26th May 2013, FPJ published a section on the book and the core message that the book tries to convey. Here you go...

As the momentum grows, and media starts to acknowledge this path breaking book, make sure you are not left behind.

Visit the RR2FF portal and get connected to this journey, where i have a mission to make you financially free

Stay connected. Write back to me and i will tell you how you can get financially free.

Cheers

"The Free Press Journal" - one of the renowned daily publication in Mumbai and 4 other Indian cities, acknowledges the attempt made by the book "From the Rat Race to Financial Freedom" as it showcases this book among some other great books and work being done in the field of art and literature.

On Sunday, 26th May 2013, FPJ published a section on the book and the core message that the book tries to convey. Here you go...

As the momentum grows, and media starts to acknowledge this path breaking book, make sure you are not left behind.

Visit the RR2FF portal and get connected to this journey, where i have a mission to make you financially free

- so that you can start to focus on the "real" things in life

- so that your ultra powerful mind can come out of this slavery of money making and start "thinking" things other than money.

- so that you can chase your true calling in life

- so that you can make a difference to the world around you.

Stay connected. Write back to me and i will tell you how you can get financially free.

Cheers

Manoj Arora

RR2FF Portal | Facebook | Twitter | Blog

.jpg)